4.1 Insurance

- The life and property of an individual are surrounded by the risk of death, disability, or destruction.

- These risks may result in financial losses. Insurance is a prudent way to transfer such risks to an insurance company.

- Important point to know before buying insurance

- Add Rider

- Accidental disability

- Critical illness

- Check these ratios before buying an Insurance

- Add Rider

- Claim Settlement ratio > * Claim amount ratio > * Solvency Ratio

4.2 Life Insurance (LI)

- Term life insurance (

Term Plan)- 0 investment(i.e. No return)

- Similar to vehicles insurance

- It’s very cheap

- Endowment policies

- Get some maturity benefits

- Whole life policies

- Pay premium for some time-frame

- But still you will get benefit for the entire life

- ULIPs

- Its premium gets invested to Stock Market

- By Govt:

- Pradhan Mantri Jivan jyoti bima yojana(

PMJJBY) - Sum assured: 2 Lakhs

- Premium: Rs. 330/pa

- Pradhan Mantri Jivan jyoti bima yojana(

4.3 Medical insurance 🚑

- Need to get admitted for 24 hrs

Personal Accidental Insurance

- Only when you meet accident

- By Govt:

- Pradhan Mantri suraksha bima yojana(

PMSBY) - Sum assured: 2 Lakhs

- Premium: Rs. 12/pa

- Pradhan Mantri suraksha bima yojana(

Health Insurance (HI) 🏥

- Check those details before buying:

1. Pre and post hospitalization

2. Premium

3. Bed Charges

4. Claim settlement

5. Tie up with hospitals

6. In house claim settlement - no 3rd party settlement

- HI includes

- Accidental cover

- Critical illness cover

- MediClaim

NOTE:- Accident and critical illness cover add as

Riderin LI - Better option than adding it in HI

- Also, less premium is required

- Accident and critical illness cover add as

How much insurance amount is needed and when?

- Take insurance only

- If Anyone depended on you

- If no-one is depended on you then –> no insurance is required

- Cover Amount

- Min –> 5 * income (Minimun insurance should be

5 times of income) - Max –> depends on income and age

- Eg of HDFC life

- Age(18 - 35) = income * 25

- Age(35 - 40) = income * 20

- Age(40 - 50) = income * 15

- Age(59 - 60) = income * 10

- Min –> 5 * income (Minimun insurance should be

4.4 Default Insurance

- Many banks and card providers(Rupay) provide a

default accidental insuranceto their Cardholders - We don’t have to pay for the insurance.

What is Accidental insurance

- Accident insurance is complementary to, not a replacement for, health insurance

- A person can avail this only if he meets an accident(road/train/flight),

- Or can be availed by the nominee on accidental demise of the insured person.

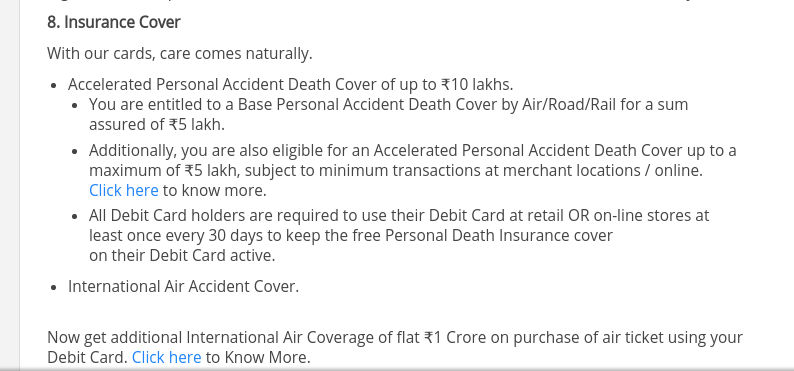

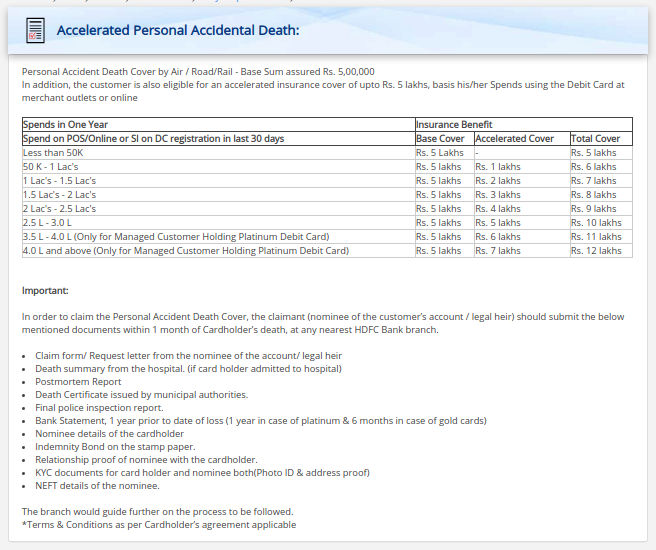

HDFC card insurance

-

HDFC provide 5L + 5L sum assured as accidental insurance to their Millennia Debit Card holders

PMJDY insurance

- People have Rupay Card form Pradhan Mantri Jan Dhan Yojana program also has Insurance

- Sum insured of Rs 1 lakh for RuPay cardholders of Old*

- PMJDY Cards and of Rs 2 lakhs for RuPay cardholders of New* PMJDY Card.

RuPay PMJDY Cards: Frequently Asked Questions

- The claim documents needs to be submitted

within 60 daysfrom the date of claim intimation - Please contact RuPay cardholder Bank / Bank branch of which RuPay cardholder has a card for intimating the claim.

- Must have done

transaction* within 90 days before the date of an accident

NOTE:

PMJDY OLD–> RuPay PMJDY Cards issued on PMJDY accounts opened till 28th Aug 2018PMJDY New–> RuPay PMJDY Cards issued on PMJDY accounts opened after 28th August 2018Transaation–> ATM/MicroATM/POS/e-com/online

Rupay Card insurance

Gayan

- Take PMSBJ and PMJJBY through net-banking from any account

PMJJBY

PMJJBY stands for Pradhan Mantri Jeevan Jyoti Bima Yojana, which is a government-backed life insurance scheme in India.

This scheme was launched by the Government of India to provide life insurance coverage at a highly affordable premium.

PMJJBY is part of the larger financial inclusion initiative to bring insurance coverage to the economically vulnerable sections of society.

Here are key features of PMJJBY:

- Eligibility:

- The scheme is available to people in the age group of 18 to 50 years.

- Individuals should have a savings bank account and provide their consent to join the scheme.

- Coverage:

- PMJJBY provides a life insurance coverage of ₹2 lakhs (rupees two lakhs) in case of the insured person’s death.

- Premium:

- The annual premium for PMJJBY is minimal, making it highly affordable for the common person.

- The premium is typically deducted directly from the insured person’s bank account.

- Renewal:

- The scheme has to be renewed annually by the policyholder. It is not a lifelong insurance coverage, and renewal is required to continue the coverage.

- Enrollment Period:

- Enrollment in the scheme is usually open from June 1st to August 31st each year.

- However, new enrollments can be allowed with the payment of a pro-rata premium.

- Claim Process:

- In the event of the insured person’s death due to any reason, the nominee can claim the insurance amount by submitting the required documents.

Reference

- Millennia Debit Card

- Hdfc: Accelerated Personal Accidental Death

- RuPay PMJDY Cards: Frequently Asked Questions

- Claims Process – RuPay Insurance Program for RuPay PMJDY

- Labour Law Advisor: Rupay Card

- Download PMJJBY certificate from here(sbi)

- Download PMSBJ certificate from here